Can Iran’s Regime Solve Its Gas Crisis?

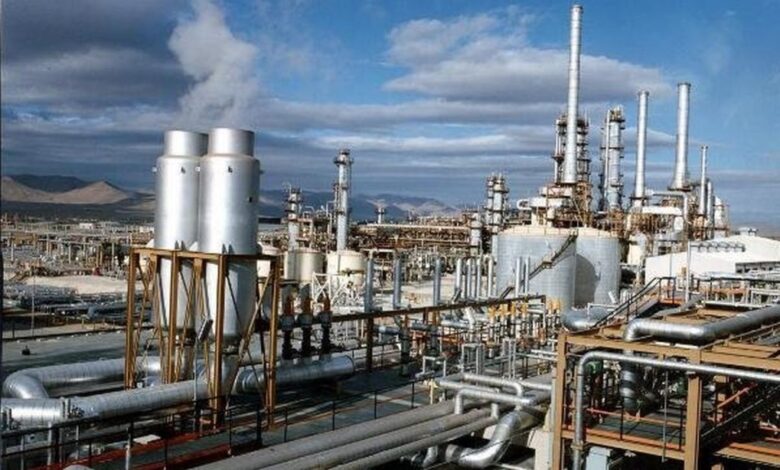

iran-natrual-gas-refinery

Written by

Mansoureh Galestan

During a three-day visit by Iranian regime Minister of Petroleum Javad Owji to Moscow for the “Russian Energy Week” conference, Russian President Vladimir Putin disclosed that “Tehran is in talks with Moscow to buy gas.”

Earlier, an agreement was signed for the regime to purchase gas from Russia during a visit by a Gazprom delegation to Iran in July last year. This visit also saw the signing of several other agreements in various energy sectors in Iran.

Nevertheless, despite Tehran’s announcement of “the largest oil and gas agreements in the country’s history worth $40 billion,” Russia has not formalized any of these memorandums into contracts. Currently, Russia is only negotiating to sell its surplus gas to Iran.

Iran, despite holding the world’s second-largest natural gas reserves, finds itself in the paradoxical position of needing to import gas. Decades of economic sanctions, a lack of investment, outdated extraction techniques, and a growing domestic demand for energy have strained the country’s gas production capabilities. Most importantly, mismanagement and corruption have hindered the development of the necessary infrastructure to harness and distribute its gas wealth efficiently.

Approximately a decade ago, the regime signed numerous oil and gas memorandums with several Russian companies, none of which were implemented.

Before the military invasion of Ukraine in February last year, Russia annually exported over 17 billion cubic meters of LNG to the European Union and an additional 133 billion cubic meters of natural gas via pipelines. These figures constituted 68% of Russia’s total gas exports in 2021.

Last year, Russia’s gas exports to the European Union via pipelines fell to less than half, and the European Union plans to become entirely independent of Russian gas by the end of this decade.

Can Iran Replace Russia in the Global Gas Market?https://t.co/OcuDoRvjL8

— NCRI-FAC (@iran_policy) May 11, 2022

The Russian pipeline to China, known as the “Power of Siberia,” has limited capacity. Moreover, Turkey is reluctant to increase gas imports from Russia. Considering the lack of prospects for developing LNG plants for gas exports to Eastern markets, Russia is now exploring the Iranian market.

Russia could export 12 billion cubic meters of gas annually to Iran through the Russia-Turkmenistan gas pipeline, extending to the Turkmenistan-Dowlatabad gas field on the border with Iran via the Dowlatabad-Sarakhs-Khangiran pipeline.

There’s also an older pipeline with an annual transmission capacity of 8 billion cubic meters of gas from Turkmenistan to Iran, unconnected to the Turkmenistan-Russia gas pipeline. However, Russia can supply an additional 8 billion cubic meters of gas to Iran through gas swap arrangements with Turkmenistan.

Every year, the regime in Iran faces a severe gas deficit in winter and is therefore prone to social unrest and protests. Hence it is hoping that investment from the Russian company Gazprom, despite its problems and huge debts of $61 billion dollars, might help the regime out of its gas crisis.

Russia’s total income from oil and gas exports has dropped by 47% in the first half of this year compared to the same period last year, reaching slightly over $37 billion.

In this challenging financial situation, Tehran’s expectation from Gazprom or the Russian government for investment in the country’s oil and gas fields just indicates a desperate move.

Facts and stats on #energy crisis in #Iranhttps://t.co/vSTBtLvV3R

— NCRI-FAC (@iran_policy) August 26, 2023

Furthermore, some of the agreements signed between Gazprom and Iran last year pertain to projects for which Russia does not possess the technology. It is also evident that Iran is a potential rival to Russia in the global oil and gas markets and its strategic alliance with Russia is severely contradicting its economic benefits.

While the regime’s Petrol Minister Owji claimed in Russia that the collaboration between the two countries could turn Iran into a “gas hub,” allowing Iran’s northern neighbors to export their gas through Iran’s territory, given the regime’s international isolation this statement remains an empty promise.

Despite signing an agreement with Pakistan during Mahmoud Ahmadinejad’s presidency to purchase gas from Iran starting in 2015, the deal remained on paper. How much imports from Russia are going to materialize this time is yet to be seen in practice.

Hence, just like other diplomatic theatrics from the Raisi administration, the recent action by the regime’s Petroleum Minister likely offers little beyond attention-grabbing headlines for the domestic audience and fodder for the regime’s internal conflicts.